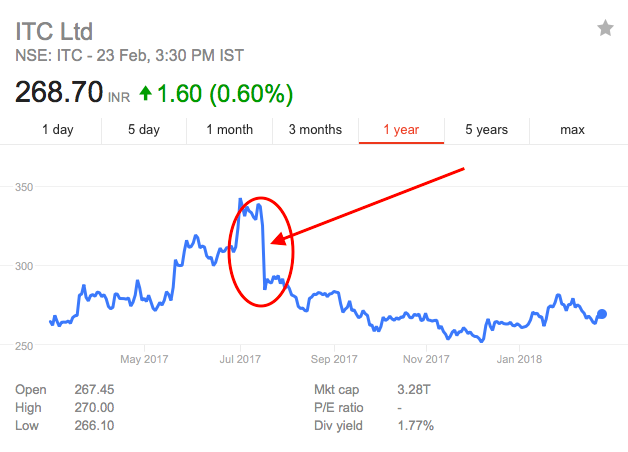

New Delhi, 1 January 2026 — ITC Ltd’s share price has come under significant pressure in early 2026, with the stock experiencing sharp declines across Indian equity markets as investors react to government policy changes affecting the tobacco sector.

As of the latest trading session on January 1, 2026, ITC share price is hovering around ₹360–₹370 on the NSE/BSE, down sharply from recent levels above ₹400. During intraday trading, the stock hit a low near ₹362.70, close to its 52-week low, before showing signs of stabilizing.

🚨 Major Drop on Policy News

The steep fall in ITC share price follows the Government of India’s announcement of a new excise duty on cigarettes, which will come into effect on February 1, 2026. The additional duty ranges from ₹2,050 to ₹8,500 per 1,000 sticks depending on product length and is levied on top of the existing 40% Goods and Services Tax (GST).

This policy move triggered widespread selling in tobacco stocks, with ITC shares falling up to 10% on the day and briefly touching levels not seen since early 2023.

📊 Market Impact

- ITC share price dropped sharply as investors reacted to higher cost and potential volume challenges.

- The stock’s market capitalization declined significantly as sentiment soured.

- Broader tobacco peers like Godfrey Phillips India also saw steep declines, reinforcing sector-wide pressure.

📉 What Analysts Are Saying

Market analysts view the excise duty hike as a short-term negative for ITC’s tobacco segment — a key profit driver for the company — as it could compel price increases and reduce cigarette volumes, potentially pushing some consumers towards illicit alternatives.

However, some brokerage reports still maintain that ITC’s diversified business model — including FMCG products, agribusiness, and paperboards — may help cushion the impact over the longer term.

📌 Key Share Price Snapshot (Latest)

| Metric | Value |

|---|---|

| Approx ITC Share Price (Jan 1, 2026) | ~₹365–₹370 range |

| 52-Week High | ~₹470+ |

| 52-Week Low | ~₹362.70 |

| Market Cap | ~₹4.5-5 Lakh crore range |

📰 Broader Context

ITC Ltd is a major conglomerate listed on both the BSE Sensex and NSE Nifty 50, with interests spanning from consumer goods and cigarettes to paperboards and agribusiness. The recent policy developments underscore how regulatory changes — especially in “sin goods” like tobacco — can rapidly influence investor sentiment and share price movements.

My name is Samar. I enjoy writing and blogging about gardens. In this website, I share information and upload blogs about beautiful Brindavan Garden.